A lot of people struggle financially nowadays especially after being affected by the Covid-19 pandemic for the past 2 years. Some used up what’s left of their savings while others choose to apply for loans.

Recently, Touch ‘n Go eWallet introduced their latest digital loan scheme known as GOpinjam. The new product’s goal is to educate first-time borrowers on debt management while also assisting Malaysians in obtaining appropriate finance. But the launch of GOpinjam is met with criticisms from the public.

Here’s a bit of info on the new product’s function. GOpinjam provides personal loans from as low as RM100 to as high as RM10,000. Customers can choose from a repayment period of one week to one year, with an interest rate ranging from 8% to 36% based on the loan amount and repayment period.

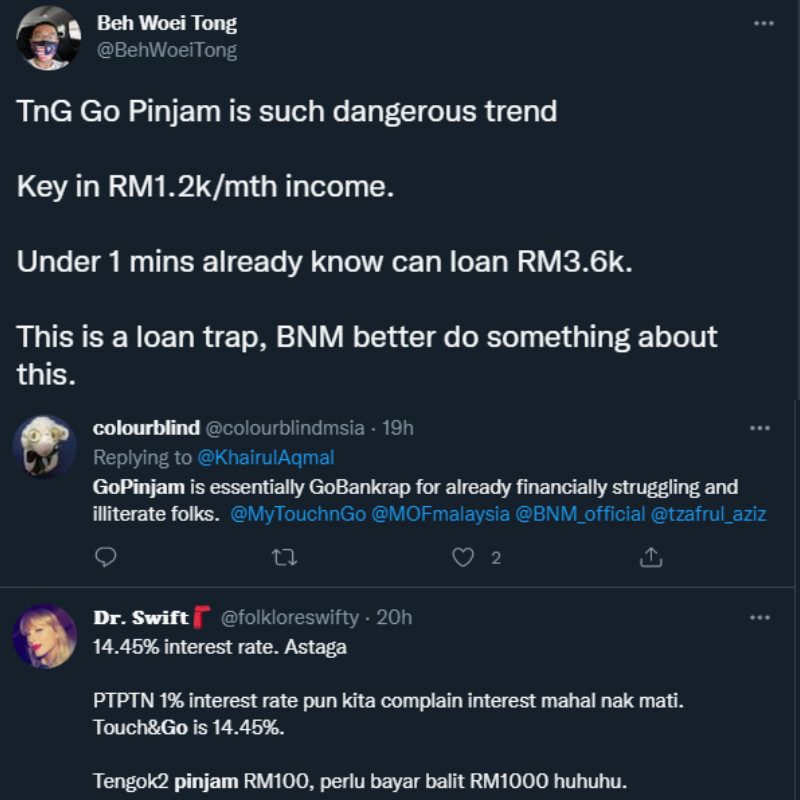

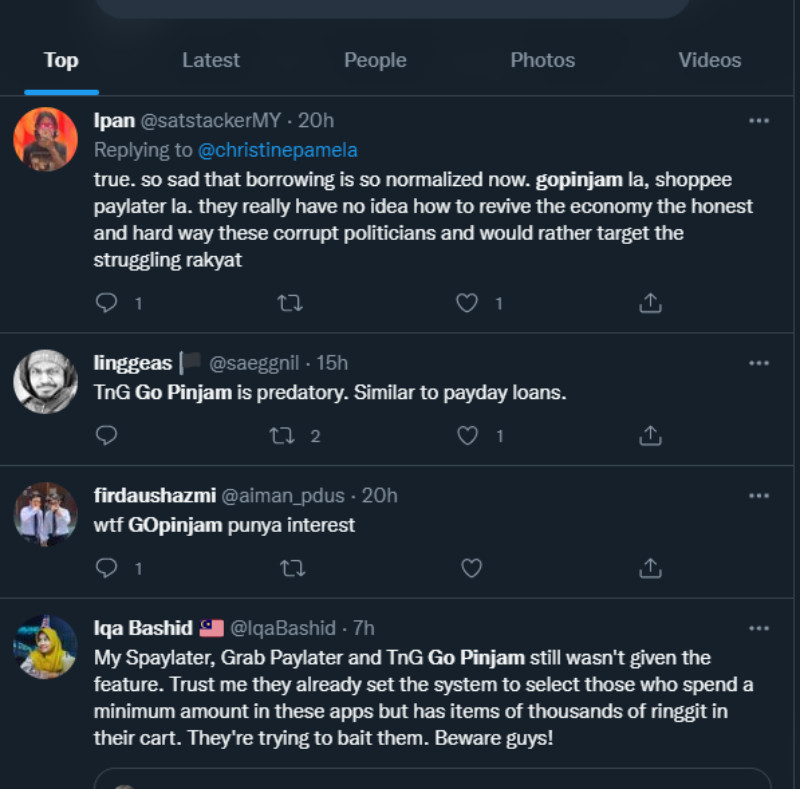

Netizens aren’t too happy with this scheme. It was the high interest rates that got everyone riled up and questioning this new initiative. Netizens took to social media to express their dissatisfaction regarding the new loan scheme and the interest rates saying that it’s unnecessary.

Some netizens compared the GOpinjam interest rates to be way higher than that of PTPTN’s which only has a 1% interest rate. Many say that GOpinjam is too dangerous for those who struggles financially and warned others to not fall for this loan trap.

Despite Touch ‘n Go eWallet’s intention to help those in the B40 category and below, many questioned how GOpinjam will actually help them get back on track if they’re still struggling financially and can’t afford the repayment. Netizens are even asking why loans are normalised and encouraged by the Government instead of solving the high living cost in Malaysia.

So far there has been no official statement by Touch ‘n Go eWallet responding to people’s concerns. For more information regarding the GOpinjam scheme, you can access it directly from the Touch ‘n Go eWallet app which you can download on Google Play Store and Apple App Store.

The post Netizens Criticise Touch ‘n Go eWallet’s New GOpinjam Loan Scheme appeared first on Hype Malaysia.

0 Comments